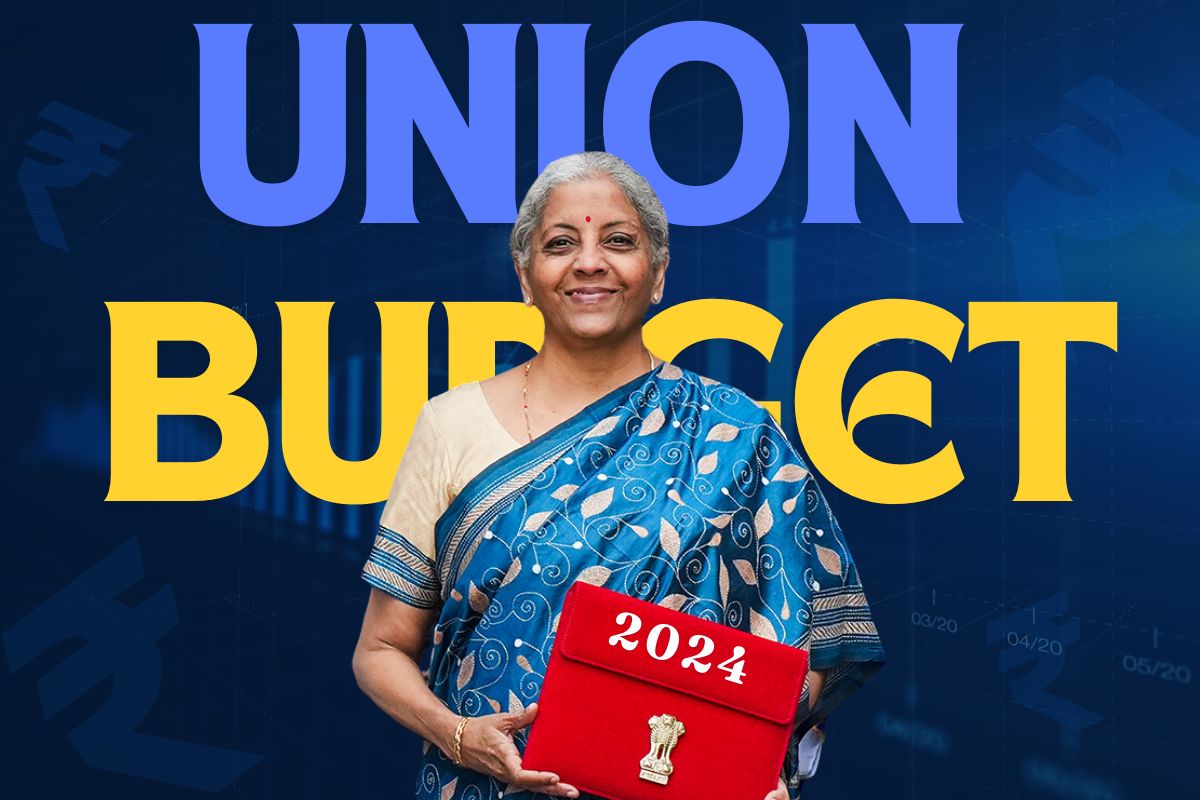

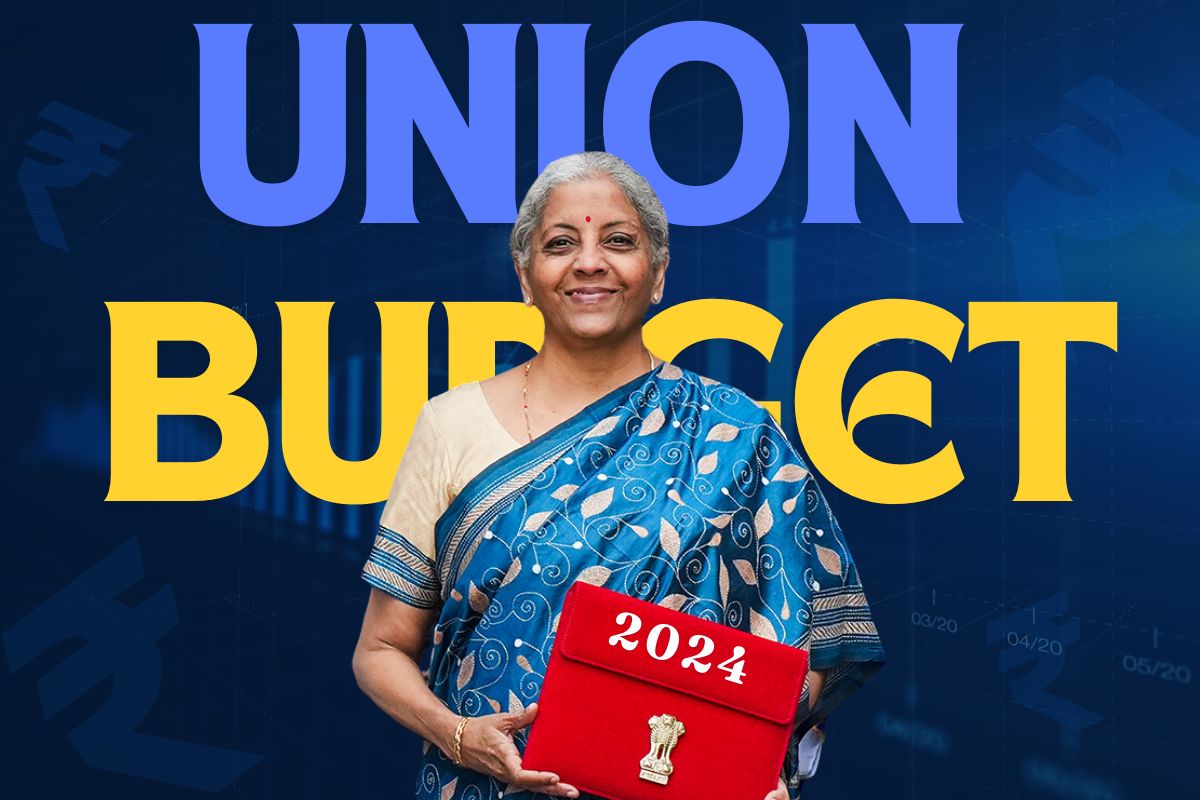

The Union Budget 2024, presented by Finance Minister Nirmala Sitharaman on July 23, 2024, has garnered significant attention for its focus on infrastructure, income tax reforms, and economic growth. This budget aims to address various sectors, including railways, healthcare, education, and more, with a vision of making India a developed nation by 2047.

FM Sitharaman lists 9 priorities of Union Budget 2024

Table of Contents

Toggle“Monetary limit for filing Tax appeals increased to Rs 60 lacs for ITAT, Rs 2 crores for high courts and Rs 5 crores for Supreme Court…I propose to abolish the Angel tax abolished for all classes of investors. Corporate tax rate to be reduced on foreign companies from 40 to 35 percent,” she said.

Revised income tax slabs for FY 2024–25 under the new income tax system The new income tax system uses slabs for taxation.

Up to Rs three lakh the tax is NIL.

The tax rate runs from Rs 3 lakh to Rs 7 lakh at 5%.

The tax rate is 10% from Rs 7 lakh to Rs 10 lakh.

Tax rate is 15% from Rs 10 lakh to Rs 12 lakh.

The tax rate, from Rs 12 lakh to Rs 15 lakh, is 20%.

The tax rate rises to 30% above Rs 15 lakh income.

“Coming to personal income tax rates, I have two announcements to make for those opting for the new tax regime. First, the standard deduction for salaries employees is proposed to be increased from Rs 50,000 to Rs 75,000. Similarly, deduction on family pension for pensioners is proposed to be enhanced from Rs 15,000 to Rs 25,000. This will provide relief to about 4 crore salaries individuals and pensioners,” finance minister Nirmala Sitharaman said.

“I announce a comprehensive review of the Income Tax Act 1961. This will reduce disputes and litigation. It is proposed to be completed in 6 months,” Sitharaman said.

“I propose to reduce customs duties on gold and silver to 6% and 6.5% on platinum,” she said.

Finance minister Nirmala Sitharaman says, “Fiscal deficit 2024-25 is estimated at 4.9% of GDP. The aim is to reach the deficit below 4.5%.

Sitharaman said the government will provide loans up to Rs 10 lakh for higher education at domestic institutions financial aid. Along with an interest subvention of three percent of the loan amount, this help will be delivered to one lakh students yearly through e-vouchers. Apart from this, the finance minister also presented many projects aimed at the domain of skill development. These comprise changing the model skill loan system, matching course material with industry skill requirements, and updating 1,000 Industrial Training Institutes (ITIs) utilising the hub and spoke model.

“Huge push to consumption through increased focus and outlay for agriculture reforms, employment generation, urban housing, etc is a big positive for the consumer sector,” says Paresh Parekh, Tax Leader – Consumer Products and Retail Sector, EY India

In her Budget speech for 2024-25, Finance Minister Nirmala Sitharaman announced that a substantial sum of Rs. 2.66 lakh crore has been earmarked for the development of rural areas, which includes the enhancement of rural infrastructure.

“This year I have made a provision of Rs. 2.66 lakh crore for rural development, including rural infrastructure,” Sitharaman stated while presenting the Budget in the Lok Sabha

Announcing PM Awas Yojana-Urban 2.0 to meet housing needs of 1 crore poor and middle-class people, Finance minister Nirmala Sitharaman

Moreover, as stated by the finance minister in the Parliament, the government will help industrial workers in PPP mode to rent dormitory style accommodation.

“Under the PM Awas Yojana-Urban 2.0, the housing needs of 1 crore poor and middle-class families will be addressed with an investment of Rs 10 lakh crores. This will include the central assistance of Rs 2.2 lakh crores in the next five years,” she said.

Setting up digital agriculture infrastructure, annual digital crop survey and mapping of farmers to their land parcels will help to improve formal credit penetration in agriculture, which presently stands at roughly 60% by means of enhanced credit risk assessment.

A fresh mechanism promised to enable MSMEs’ ongoing bank loan continuation during their crisis phase. Limit of Mudra loans rose from Rs 10 lakh to 20 lakh. From Rs 500cr to and Rs 250cr, turnover threshold of buyers for mandatory onboarding on TREDS platform would be lowered. 50 multi-product food irradiation units in the MSME sector receive financial help. E-Commerce export hubs established up in PPP* method will help MSMEs and traditional artists to market their goods abroad.

Finance minister Sitharaman declared that the government is poised to start an internship programme for 1 crore young people in more than 500 companies, therefore greatly benefiting the employment and skill development sector.

“The Government will launch a scheme to provide internship opportunities to 1 crore youth in 500 top companies with Rs 5000 per month as internship allowance and one-time assistance of Rs 6000,” she said.

“Andhra Pradesh Reorganisation Act- Our govt has made efforts to fulfil the commitments in Andhra Pradesh Reorganisation Act. Recognising the state’s need for capital, we will facilitate special financial support through multilateral agencies. In the current FY, Rs 15,000 crore will be arranged with additional amounts in future years,” Sitharaman said.

“Government to provide financial support for loans up to Rs 10 lakhs for higher education in domestic institutions,” she said.

“Our govt will implement three schemes for employment-linked incentives as part of the Prime Minister’s package. These will be based on enrollment in the EPFO and focus on recognition of the first time employees and support to employees and employers,” she said.

The Union Budget 2024 government has budgeted Rs 26,000 crore for different road projects in Bihar, as stated by Finance Minister Nirmala Sitharaman in her 2024-25 budget. The Centre will seek financial help from multilateral development agencies for the state.

In addition to road developments, the government intends to build airports, medical colleges, and sports facilities throughout Bihar. The Centre would also construct a comprehensive strategy known as ‘Purvodaya’ to promote overall development in Bihar, Jharkhand, West Bengal, Odisha, and Andhra Pradesh.

Furthermore, the government intends to assist the creation of an industrial corridor in the eastern region. The finance minister also announced that the government will directly issue e-vouchers to 1 lakh students each year, along with a 3% interest subsidy on their loan amount.

Jobs has to be at the core of economic growth. It is good to see jobs, skills, and education at the core of the Budget speech. Translating the allocation and new initiatives into action, making it demand driven, not supply driven can only ensure the success of this intent,” says Nilaya Varma, Co-Founder and CEO at Primus Partners