Pakistan’s Deputy PM Labels Pahalgam Attackers as ‘Freedom Fighters’, Escalating Diplomatic Tensions

Given that the latest advanced estimates had predicted an increase in India’s economic growth nation’s product by 6.4%, this fear is one such element behind anticipation for the future: Last year’s GDP growth rate was 8.2%.

It is anticipated that the Indian economy’s growth rate will drop significantly next year to 6.4%. The deceleration in various key areas has resulted in the lowest growth rate of China’s economy since the epidemic.

Table of Contents

Toggle

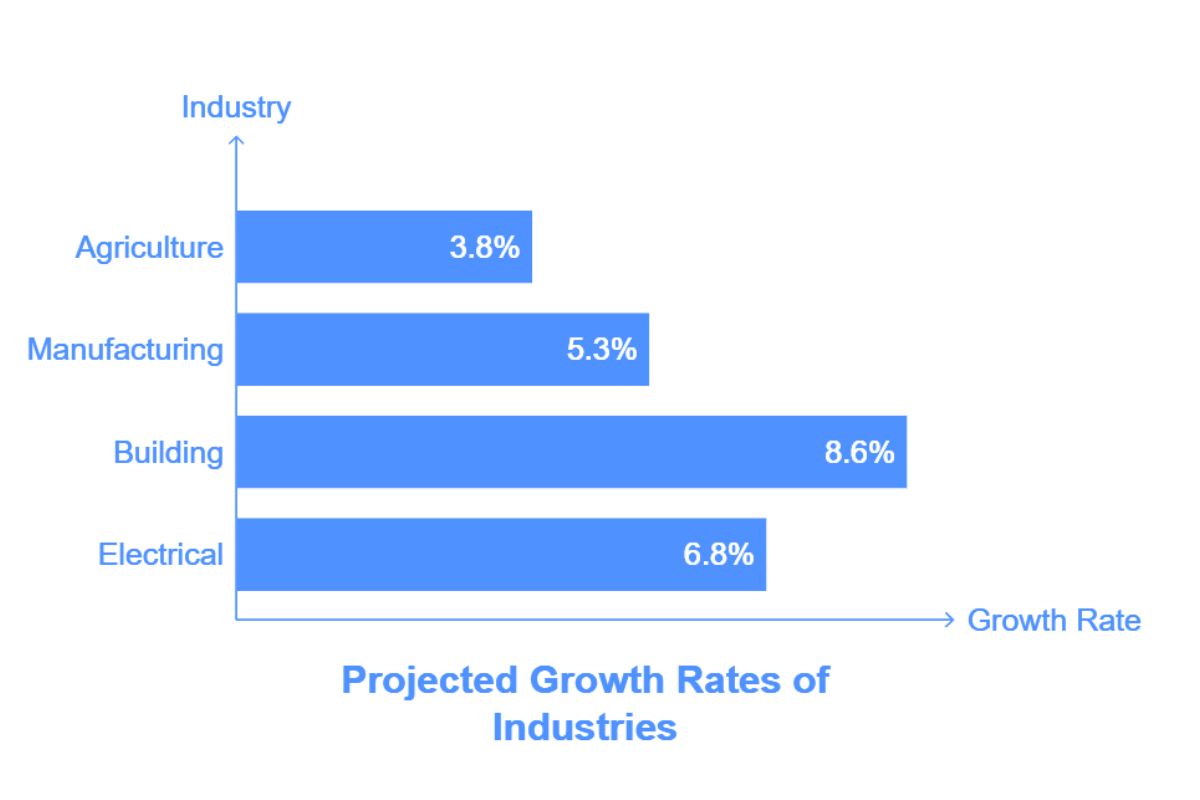

The majority of other industries are predicted to slow down, however, agriculture is likely to enjoy a significant increase with a growth projection of 3.8% compared to 1.4% last year. With a growth rate of 9.9% last year, manufacturing was a key driver of growth; this year, it is expected to increase at a rate of 5.3%. In a similar vein, the building industry is predicted to expand by 8.6%, down from 9.9%, and the electrical sector is predicted to rise by 6.8%, down from 7.5% the year before.

Slower growth is anticipated in FY25 for the major GDP contributors, including manufacturing, trade, hotels, financial services, and real estate. The purchasing power of the urban poor has been eroded by inflation, which has also had a significant impact on urban consumption.

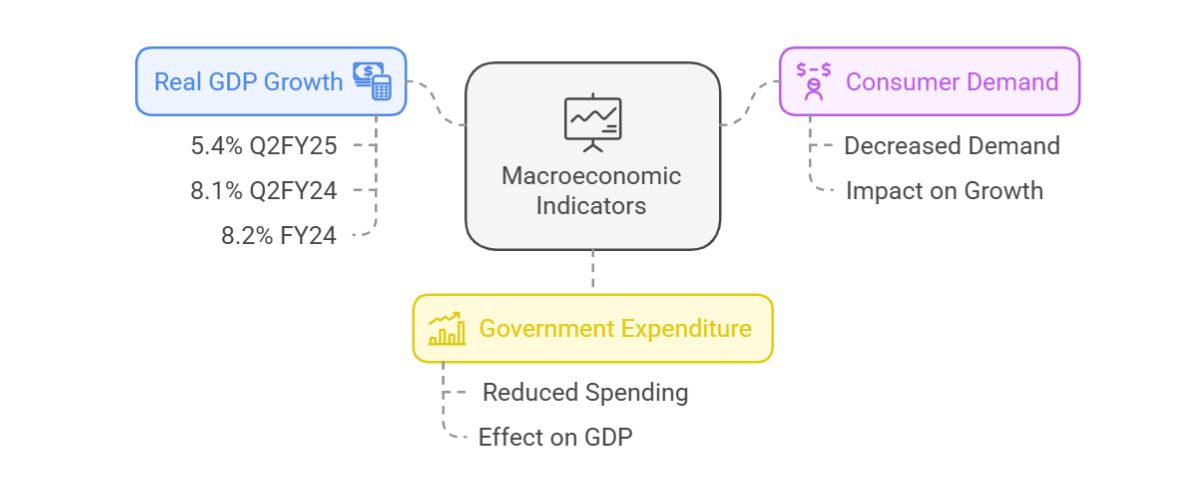

The macro socioeconomic panorama in CY24 was a mixed picture. After last year’s exuberant performance, the main indicators displayed signs of waning strength in 1HFY25. Growth in real GDP eased slightly this year to 5.4% (yoy) in Q2FY25 from 8.1% Q2FY24, dropping off steeply compared with the 8.2% aggregate rate of FY24, mainly due to lighter consumer demand and some reduction in government expenditure.

Indian stocks continued to rise despite major internal and international obstacles; the Nifty50 saw a 9% gain, and the country’s market capitalisation reached USD 5.2 trillion, or 4.2% of the world market capitalisation. For the year, the Midcap and Smallcap indices are expected to yield significantly higher returns of about 24%.

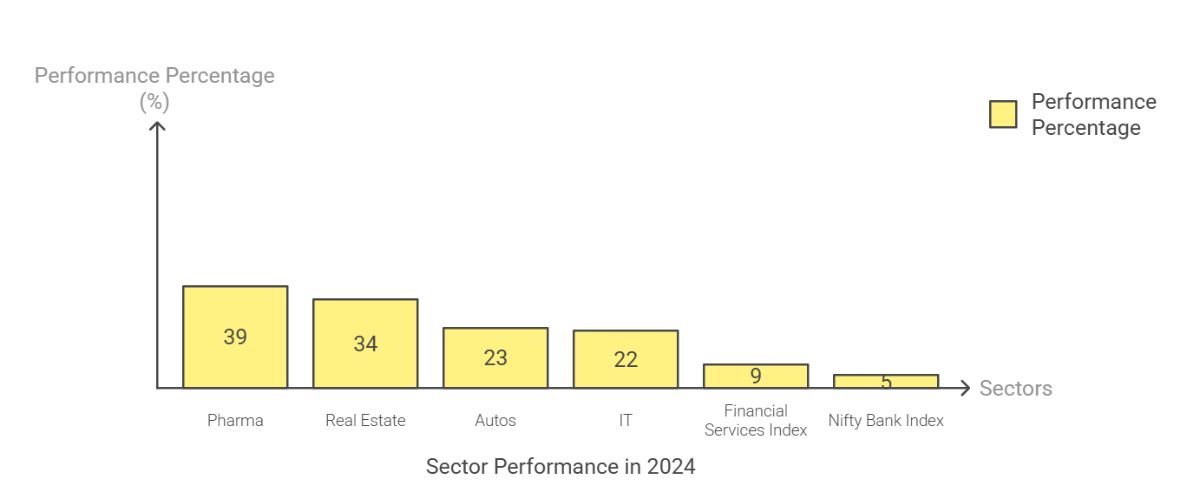

In terms of sectors, Pharma (+39%) and Real Estate (+34%) were the best-performing sectors of 2024, while Autos (+23%) and IT (+22%) also performed well. However, the broader financial services index (+9%) was able to match Nifty50 returns, while the Nifty Bank index (dominated by large private banks) underperformed with just a 5% gain during the year.

The year was marked by significant global and domestic headwinds like geopolitical tensions, persistent inflation, strengthening USD, and elevated interest rates. On the global front, events such as the US Fed’s rate cut cycle, China’s stimulus measures, and geopolitical uncertainties, including the US presidential election, created significant market volatility.

The Reserve Bank of India (RBI) changed its stance to neutral but kept the policy rates unchanged due to moderating, yet still elevated inflation which is above the RBI’s threshold of 4%. The rate cut by the RBI is expected in February 2025.

India’s economic growth forecast for FY25 paints a picture of a slowing economy, with several sectors experiencing a decline in growth rates. The government’s fiscal policies and the RBI’s approach to managing inflation and growth will play a crucial role in determining the broader economic outlook